In a comment piece today, I make the case for OPEC’s impending implosion, following their disastrous meeting on Wednesday in which the member countries could not agree over oil production, despite predictions they would do so.

Following news that Saudi Arabia is ready to pump as much oil as the market needs, I say:

“the largest member of OPEC is simply ignoring the cartel’s inactions that these days pass for decisions, despite the obvious rage this will cause and the risk it poses to the integrity of the cartel itself. It would be difficult to imagine a more stark rejection of OPEC’s quota system than that.

And in a world where oil demand is rising to meet oil supply, who needs a producers’ cartel anyway?”

But this is just one view. The politically-driven problems between Iran and Saudi could be resolved if relations within the Iranian governing regime improve.

Reluctant OPEC members may be scared into increasing production at the prospect of OPEC’s diminishing credibility.

Events in the MIddle East and North Africa may calm, reducing the risk premium many analysts say is attached to current oil prices.

Or I could be mistaking a spat between politicians as an institutional crisis.

So, what do you think? What does the OPEC meeting, or high oil prices, mean for your business? Please comment below.

UPDATE 12/06/2011:

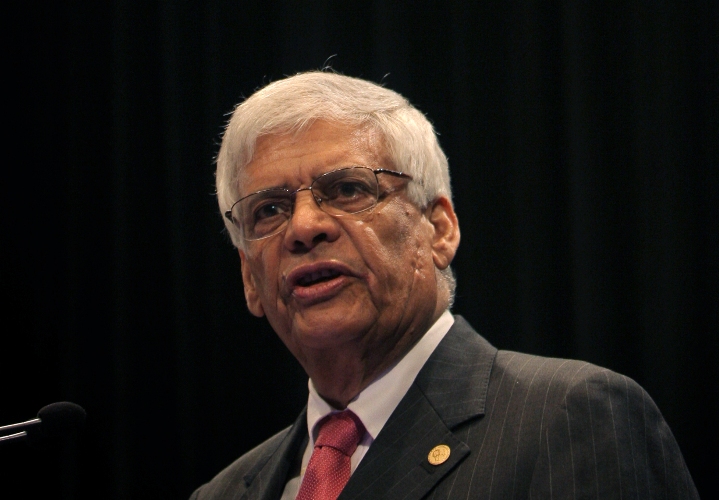

Robin Mills, Non-Resident Scholar at INEGMA, gives his analysis.