Oil & Gas Middle East presents its fingertip guide to the biggest energy projects in the Middle East today

The twenty largest exploration and production projects the the Middle East represent a whopping US$229 billion worth of investnment.

In addition to these we could have thrown in giant associated projects such as the UAE’s first foray into rail, a project with a value topping $10 billion, and initially exclusively to serve the Shah Gas Field development, shuttling sulphur from the sour gas processing facilities to its export terminal, but we did not.

These projects represent the largest ongoing and under execution projects in the region, ranked by estimated total dollar value.

1. West Qurna (combined phases I & II)

In November 2009, an Exxon Mobil – Shell joint venture won a US$50 billion contract to develop the 9-billion-barrel West Qurna Phase I. As per Iraqi Oil Ministry estimates, the project will require a $25 billion investment and another $25 billion in operating fees creating approximately 100,000 jobs in underdeveloped southern region.

ExxonMobil is set to increase the current production of 0.27 to 2.25 million barrels per day in just seven years. The Iraqi government, in turn, will shell out a paltry $1.90 per barrel produced by ExxonMobil-Shell alliance.

In December 2009, Russia’s Lukoil and Norway’s Statoil were awarded the rights to develop the 12.88-billion-barrel West Qurna Phase II oil field. The Lukoil-Statoil alliance will receive just $1.15 per barrel that they produce. In addition, they will work to raise output from West Qurna 2 to 120,000 barrels per day by 2012 and 1.8 million barrels per day over a period of 13 years.

Lukoil CEO Vagit Alekperov has said the contract had an option to be extended for another five years.

He also said LUKoil will invest $4.5 billion in West Qurna-2 within the next three to five years, adding that his company had already invested some $300 million in start-up work and the search for contractors.

Recently Baker Hughes won a contract from Lukoil to offer full drilling and completion services for 23 wells at its West Qurna Phase II field in Iraq.

Under the two-year contract, Baker is entitled to provide supply drilling services, formation evaluation, casing and tubing running services, completion tools and services, wellbore intervention services, wireline logging as well as perforation operations.

Interestingly, the company expects to contract all third-party services, equipment, personnel, tools and materials required for the project, including five drilling and three workover rigs.

In May 2011 Schlumberger secured a contract from ExxonMobil to drill 15 new wells at West Qurna 1, and back in April Halliburton was awarded a contract to provide drilling services for 15 wells in the Phase I development, covering a range of well construction services and three drilling rigs to deliver the wells.

Initial field production of 244,000 barrels per day has now been increased to 285,000 barrels per day, which exceeds the 10% improved production target established under the technical services contract.

In February this year Fluor confirmed Exxon had awarded the firm a three-year rolling early works EPC contract for the Phase I element of the field for an undisclosed sum.

Project: West Qurna (Phase I & II)

Country: Iraq

Type: Oil E&P

Budget: $54.5 billion

Completion: 2021

Major players: Exxon, Shell, LukOil, Statoil, Halliburton, Baker Hughes, Schlumberger, fluor

2. South Pars

The most significant energy development project in Iran is the offshore South Pars field, which is estimated to have 450 trillion cubic feet of natural gas reserves, or around 47 percent of Iran’s total natural gas reserves. Discovered in 1990, and located 62 miles offshore. South Pars has a 25 phase development scheme spanning 20 years. Phases 1-10 are online.

The entire project is managed by Pars Oil & Gas Company, a subsidiary of the National Iranian Oil Company.

In June, Iranian Deputy Oil Minister Javad Oji announced that the country plans to double the capacity of its natural gas production in less than four years.

Oji reiterated that Iran plans to invest more than $38 billion in its gas projects by the end of the country’s Fifth National Development Plan (2010-2015).

Total investment allocation for the South pars development has been pegged at $60 billion, but for the purposes of our ranking we have included monies allocated for active elements of the project phases in currently in execution.

In the wake of economic sanctions against Iran, most western E&P firms have exited the project. In 2009 National Iranian Oil Company and CNPC signed a US$5 billion contract for the development of phase 11 of the South Pars gas field, replacing France’s Total. Iran expects to earn $110 billion annually from the field.

Project: South Pars

Country: Iran

Type: Offshore Gas Development

Budget: $38 billion

Completion: (Phase Five) 2015

Major players: Pars Oil & Gas Company, CNPC

3. Majnoon

Royal Dutch Shell and Petronas signed a 20-year contract to provide technical assistance in the development of the giant Majnoon oilfield in 2010.

The field is though to hold in excess of 25 billion barrels of oil Shell, as lead operator, holds a 45% share, with partner Petronas holding 30%. The Iraqi state holds 25% of the participating interests in all licences. The consortium targets a production plateau of 1.8 million b/d, up from a current level of approximately 45,000 b/d.

Halliburton won a contract to drill 15 wells at the super-giant Majnoon oilfield in August 2010. In July ENKA, a Turkish construction and energy company won a $60 million contract to install two crude storage tanks and four pumping units which will connect a pipeline network at three well-pads.

Earlier this year, local EPC giant Petrofac netted a major contract, in excess of US$240 million by Shell for developments in the Majnoon Field.

Petrofac is providing engineering, procurement, fabrication and construction management services for the development of a new early production system comprising two trains each with capacity for 50,000 barrels of oil per day, along with upgrading of existing brownfield facilities. Work began in mid-2010 and is expected to complete during Q4 2012.

Project: Majnoon

Country: Iraq

Type: Oil E&P

Budget: $20bn+

Completion: 2030

Major players: Shell, Petronas, Halliburton, Petrofac, Enka

4. Upper Zakum

ZADCO has taken a huge leap away from traditional production platforms by building production islands to boost output at the giant Upper Zakum Field.

Abu Dhabi’s Zakum Development Company (ZADCO) is working at full stretch on the enormous expansion of drilling and production to achieve its goal to produce 750 000 barrels per day (bpd) of crude oil by 2015 – dubbed the UZ 750 project – raising output by 200 000 bpd.

In order to achieve the huge ramp up, ZADCO is shifting from offshore platform production to a network of four artificial islands (three satellites and one main central island), from which greater production is anticipated. Drilling reach will be extended from 10 000 feet to around 30 000 feet from the new islands using ZADCO shareholder ExxonMobil’s extended reach drilling technology.

The contract to construct the four artificial islands was awarded to the Abu Dhabi based National Marine Dredging Company in 2009. After a series of trials construction of the South Island began in August 2010 with the first visible signs appearing above the waves in October (pictured above).

Although there are many more months of work ahead to place three million cubic metres of dredged material to complete the island, the appearance of sand above the high water level marked a milestone in the transition from wellhead platform tower (WHPT) based facilities and jack-up rig drilling to island based facilities and land rig based drilling.

ZADCO is the first ADNOC company to intensively apply these complex drilling completions in terms of extended reach drilling and maximum reservoir contact.

Project: Upper Zakum

Country: UAE

Type: Oil E&P

Budget: $15 billion

Completion: 2015

Major companies: ZADCO , National Drilling Company, Exxon Mobil

5. Rumaila

In November 2009 a BP-led consortium won the contract to develop Iraq’s largest oilfield at Rumaila.

The BP-PetroChina deal was secured when the consortium agreed to cut its fee per barrel from US$3.99 to a measly $2. Exxon-Mobil had been the favourite to develop the 17.8bn barrel Rumaila oilfield, but it was widely reported the company had refused to accept the low fees imposed by the oil ministry.

The project’s principal objective is to increase oil production from 2.4 million barrels per day to more than 4 million in the next five years.

Worley Parsons was awarded the contract by the consortium and the State Oil Marketing Organisation (SOMO) of the Republic of Iraq, to provide conceptual design, front end engineering design, minimum work obligations and integrated project management team services to boost production from the oil field.

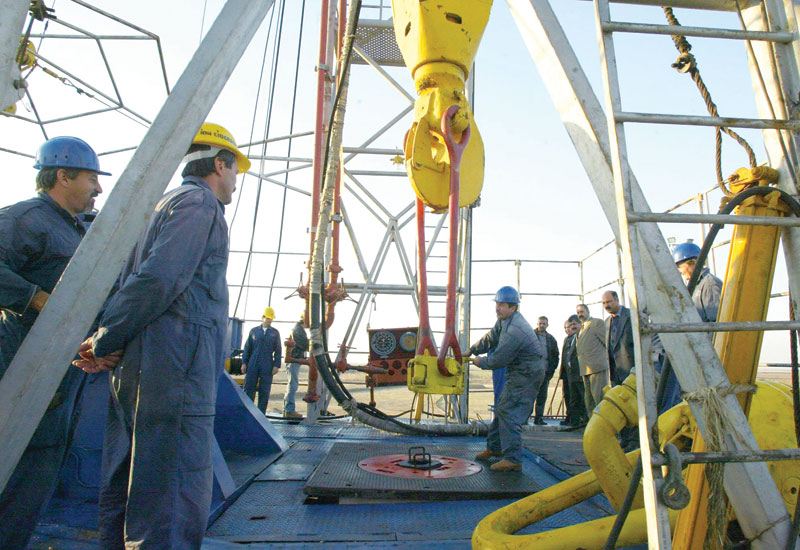

The pace of activity on Rumaila has built steadily over the past year. A total of 20 new rigs are now mobilized in the field. Over the course of 2010, a total of 41 wells have been drilled, 103 workovers completed and 122 kilometers of flowlines laid. Some 10,000 people are currently working on Rumaila, over double the number at the beginning of 2010.

Project: Rumaila

Country: Iraq

Type: Oil E&P

Budget: $15 billion

Completion: 2029

Major Players: BP, PetroChina, Worley Parsons, Oil Marketing Company of Iraq (SOMO), South Oil Company (Iraq)

6. Oman Gas Development

BP signed a major production-sharing agreement on 22 January 2007 to appraise Block 61, containing 4 gas reservoirs that could yield resources of some 20 – 30 trillion cubic feet of natural gas. Block 61 covers an area of 2,800 square kilometres in central Oman, including the Khazzan and Makarem gas fields which were discovered in 1990’s but have remained undeveloped due to the complexity of the ‘tight gas’ reservoirs.

The company has recently confirmed its interest in stepping up its investment to the $15 billion project. Final ramp-decisions will be taken in spring 2012. “We have plans to have 300 wells, and this will be one of the largest projects, could be, in BP’s portfolio,” CEO Bob Dudley told the World NOC Congress.

BP is currently conducting a multi-year programme to fully appraise the reservoirs. After an innovative 3D seismic program over 2,800 square kilometres, seven appraisal wells have now been drilled and stimulated.

Mohammed bin Hamed al-Rumhy, Oman’s Minister of Oil and Gas and chairman of state oil company Petroleum Development of Oman, said the $15 billion cost estimate reflected expected expenditure over 10-15 years. BP has not confirmed the estimate.

Project: Oman Gas Development Project (Khazzan-Makarem gas field)

Country: Iraq

Type: Gas gathering

Budget: $15 billion

Completion: 2035

Major Players: BP

7. Shah Field Gas Development

Abu Dhabi National Oil Company (ADNOC) and Occidental Petroleum Corporation have reached an agreement for Occidental to join the development of the Shah Gas Field in the Emirate of Abu Dhabi, United Arab Emirates in January this year.

Occidental will take a 40% participating interest while ADNOC will retain its 60% participating interest.

The project will involve several gas gathering systems, construction of processing trains to process one billion cubic feet per day of gas at Shah to produce around 500 million cubic feet per day of network gas and other related hydrocarbon liquids, in addition to new gas and liquid pipelines.

Korea’s Samsung Engineering and Italy’s Saipem have won an aggregate of about $5 billion in contracts for gas processing and sulphur recovery. Saipem won contracts for $1.9 billion for gas processing, $1.45 billion for sulphur recovery and $196 million for product pipelines.

Tecnicas Reunidas and Punj Lloyd Group also won a joint contract worth $463 million for gas gathering. Fluor and CH2M Hill Companies unit Veco Corp. signed project management contracts for the Shah project earlier this year.

Project: Shah Field Gas Development

Country: UAE, Abu Dhabi

Type: Gas Production and treatment

Budget: $11.3 billion

Completion: Q1 2015

Major companies: OXY, ADNOC , Metito, Honeywell, Al Jaber group, Fluor, Veco Corp, Saipem, Siirtec

8. Iraq gas fields

Iraq finally signed an agreement in July with Royal Dutch Shell and Mitsubishi for a US$12 billion deal to capture flared gas at southern oilfields in August.

The long-awaited deal still needs the approval of Iraq’s cabinet, Oil Minister Abdul-Kareem Luaibi said in a statement, however, at this stage it is thought to be a formality.

Iraq has struggled for years with power blackouts and risks years of electricity shortages until associated gas from oilfields is captured and fed to new power plants.

The joint venture, named Basra Gas Co, would be at the forefront of Iraq’s plans to modernize its energy facilities and boost oil exports. “The execution of the deal will open the competition door for Iraq to export liquefied natural gas to the international market,” Ali al-Khudhier, head of state-run South Gas Co. said in a statement.

Iraqi officials previously have said the initial plan for the 25-year development joint venture includes setting up a liquefied natural gas project at a later stage to export any excess gas with a maximum capacity of 600 million cubic feet of gas per day.

The venture would help Iraq capture more than 700 million cubic feet per day of gas being burned off at three southern oilfields — Rumaila, Zubair and West Qurna Phase One.

Project: Gas Capturing at Southern Oilfields

Country: Iraq

Type: Flared Gas Capture

Budget: $12 billion

Completion: 2035

Major Players: Shell, Mitsubishi, South Gas Company

9. Karan

Saudi Aramco has said it will deliver the Karan offshore non-associated gas development onstream next year, ahead of its 2013 schedule. When fully operational in 2012, the project will produce 1.8 billion cf/d of raw gas.

In its 2010 annual review Aramco added that a 400-mmcf/d initial production “planned during peak summer demand [will be] starting in 2011”, meaning early production may have started.

With its first offshore non-associated gas development delivered ahead of schedule, Saudi Aramco will be continuously optimistic about completion of its Hasbah and Arabiyah offshore gas projects, which it has also fast-tracked for completion in 2013, to be fed into the Wasit gas project.

Karan, designed to produce 1.8 billion scfd of raw dry gas to support the company’s Master Gas System, will produce from 21 increment wells distributed over five offshore wellhead platforms.

The gas production is being staged, with five wells already drilled and completed. Gas from those functioning platforms will be tied-in for 400 million scfd in early production planned for four months during 2011 summer peak demand.

Three other platforms with 14 wells will be drilled, completed, tied-in and on stream in June 2012, and the remaining two wells and platform will be ready in April 2013, bringing the field to full-capacity production.

By January 2011, overall drilling and completion progress was 78 percent. Produced gas will be co-mingled at one Tie-In Offshore Platform through five 20-inch subsea flowlines.

Then, gas will be transported via one 38-inch subsea pipeline onshore to the Khursaniyah Gas Plant (KGP), where new gas-processing facilities are currently being constructed.

Project: Karan offshore non-associated gas development

Country: Kingdom of Saudi Arabia

Type: Offshore Gas

Budget: $10 billion

Completion: 2012

Major Players: Saudi Aramco, J. Ray McDermott, Petrofac, Hyundai

10. GASCO’s IGD

The Abu Dhabi Gas Industries (GASCO) Integrated Gas Development (IGD) project is aimed at adding new onshore and offshore gas processing facilities at Habshan and Ruwais in Abu Dhabi.

The new facilities of the IGD project will enable gas to be received from the Umm Shaif field and processed at Habshan and Ruwais. The project is expected to be completed by 2013.

Fluor was awarded the Front End Engineering and Design (FEED) contract for the project. The company completed the FEED study in July 2008. In May 2007, KBR was awarded a contract for providing project management for the onshore and offshore facilities of the Habshan complex. The contract was valued at $30m.

In July 2009, GASCO awarded engineering, procurement, construction and commissioning (EPCC) contracts for various components of the project. A joint venture, formed between Japan’s JGC Corporation and Italy’s Maire Tecnimont, was awarded the EPCC contract for the Habshan 5 processing facility, sulphur recovery units and NGL recovery unit.

The total value of the contract is $4.7bn. JGC and Technimont subcontracted Kuwait-based Kharafi National for the construction of the processing facility. The contract is valued at $728m.

The JV also awarded a $13.8m sub-contract to Abu Dhabi-based Ducab to supply power cables for the project. In August 2010, JGC and Technimont awarded a contract to Elliott Group to provide 16 compressor trains for the processing facility.

Project: Integrated Gas Development project

Country: UAE, Abu Dhabi

Type: Gas

Budget: $10 billion

Completion: 2013

Major players: Fluor, KBR, Marie Technimont, JGC Kharafi, National, Elliot Group, Target Engineering, CB&I, Hyundai Engineering, GE Oil & Gas, Petrofac

11. Manifa

Saudi Aramco confirmed in its annual review that it is moving full tilt forward with plans to accelerate the Manifa development, bringing the 900,000-b/d heavy and sour oilfield fully onstream by 2014. A first-phase development would yield 500,000 b/d of production by 2013.

“Significant progress was achieved in 2010 on Manifa, the giant Arabian Gulf offshore field under development”, the report said, moving the full production date forward even further from recent comments by senior executives, which put the field’s completion to 2015. The offshore field had been earmarked for a staggered development, bringing it onstream in increments to 2024.

The Manifa Field is located in shallow waters and the development involved the construction of 27 drilling production islands and 2 water injection islands linked by a causeway to the new onshore processing facilities.

The first of the major LSTK packages was awarded to Jan de Nul to contruct the drilling islands and causeway, and J. Ray McDermott for EPC, hook-up and commissioning the facilities.

FEED and PMC was awarded to Foster Wheeler in 2006. Major EPC contracts for the onshore facilities were awarded to Saipem for the Central Processing Facilties, JGC for the utilities package and Tecnicas Ruenidas for the Cogeneration package. Tecnicas Reunidas is supplying two heat recovery steam generators.

Project: Manifa Arabian Heavy Crude Project

Country: Kingdom of Saudi Arabia

Type: Oil E&P

Budget: $10 billion

Completion: 2013

Major players: Saudi Aramco, Foster Wheeler, Jan de Nul, J.Ray, McDermott, Saipem (Snamprogetti), JGC Corp, Tecnicas Ruenidas, Sumitomo Corp.

12. Barzan

Qatar Petroleum (QP) and ExxonMobil are well underway in the development of the Barzan Gas Project, which is to cost an estimated $9bn. QP has a 93% share and ExxonMobil the remaining 7% in the venture.

The Barzan project, in Ras Laffan Industrial City, will be operated by RasGas Company Limited to produce and process gas from Qatar’s North Field to supply gas to power stations and industries in Qatar, including ethane to the local petrochemicals sector.

The project is expected to supply 1.4 billion cubic feet per day of gas with the first gas flow planned for 2014.

Onshore and the offshore engineering, procurement and construction contracts have been awarded to JGC of Japan and Hyundai Heavy Industries of South Korea, respectively, who won the contracts in competitive bidding. A major portion of the gas will be used by the power and water generation sector. It will also produce more than 300,000 barrels of oil each day.

“When Barzan starts production we will have achieved our target of producing plateau of 23 billion standard cubic feet of gas per day from the North Field; which is equal to producing more than five million barrels of oil equivalent when you add the crude oil production,” said former Qatar Energy Minister Abdullah al-Attiyah.

Project: South Pars

Country: Iran

Type: Offshore Gas Development

Budget: $38 billion

Completion: (Phase Five) 2015

Major players: Pars Oil & Gas Company, CNPC

13. Wasit

The Wasit Gas Program will construct an onshore grassroots Central Processing Facility (CPF) to process 2.5 billion scfd of gas from the Arabiyah/Hasbah offshore fields and produce approximately 1.75 billion scfd of sales gas.

Offshore gas wellhead production and tie-in platforms along with associated pipelines and cables will be installed to provide the feed gas to the CPF.

The program also provides for installing Natural Gas Liquid (NGL) fractionation facilities inside the Wasit CPF to allow for processing a 240,000 bpd C2+ NGL stream produced at Khursaniyah.

The winning contractors for Wasit Gas onshore facilities were unveiled in January. SK Engineering & Construction was selected for Lump Sum Turn Key (LSTK) contracts to perform the EPC work for the inlet and gas facilities, NGL fractionation and the sulfur recovery units and utilities facilities.

Samsung Engineering was selected for a LSTK contract to perform the EPC of the cogeneration and steam generation facilities. In March Saipem was awarded Wasit E&C offshore contracts worth in excess of $2.2 billion. This covers the offshore development of the Arabiyah and Hasbah fields, from which gas will flow to the Wasit plant.

Project: Wasit Gas Programme

Country: kingdom of Saudi Arabia

Type: Gas

Budget: $6 billion

Completion: 2013

Major players: Saudi Aramco, SK Engineering, Samsung Engineering, Mohammad Al Mojil Group, Saipem

14. ADCOP Pipeline

The Abu Dhabi crude oil pipeline project, also known as the Habshan-Fujairah pipeline, was initiated by the International Petroleum Investment Company (IPIC), which is owned by the Abu Dhabi Government.

The pipeline originates at Habshan and end at Fujairah, UAE, covering a distance of around 400km. The 48in-diameter pipeline will have a nominal capacity to transport 1.5 million barrels per day of crude oil, equivalent to more than half of the UAE’s total crude oil export.

The pipeline’s maximum capacity is 1.8 million barrels per day. Construction began in March 2008. The bulk of the project work was completed in March this year, but the mega-project sneaks into our list as it has not yet reached full operational capacity, which is expected sometime next year.

The project was conceptually designed by Tebodin in 2006. ILF Consulting Engineers was selected to provide project management services in April 2007.

The FEED contract was given to WorleyParsons in September 2007. The pipe supply contract was given to Sumitomo Corporation, Salzgitter Mannesmann and Jindal Group in December 2007. ABB are providing the electronic systems, and Germanischer Lloyd will certify the finished project.

Project: Abu Dhabi Crude Oil Pipeline Project

Country: United Arab Emirates

Type: Pipeline

Budget: $3.29 billion

Completion: 2011

Major players: Tebodin, ILF Consulting Engineers, Maps Geosystems, Fugro Middle East, Sumitomo Corporation, Salzgitter Mannesmann International and Jindal, Group, China Petroleum Engineering & Construction Corporation (CPECC), Van Oord Offshore, Bluewater Energy, Germanischer Lloyd

15. Shaybah

The Shaybah NGL Program will construct a grassroots NGL recovery plant at the remote field in Saudi Arabia.

This facility will extract the valuable NGL components supplied from various gas-oil separation plants (GOSPs) and deliver lean gas to GOSP-2 and GOSP-4 for re-injection.

The Shaybah NGL Program also includes gas handling facilities to debottleneck Shaybah GOSP-1, 2, 3 & 4.

Samsung Engineering is performing the EPC work for all four packages. The scope of the major packages includes the construction of the inlet facilities, NGL recovery trains, dehydration, residue gas compression, acid gas compression, NGL storage and shipping, the upgrade of the gas handling capacity for the four existing Shaybah gas oil separation plants (GOSPs) and other associated facilities.

Following the awards of Malaysia’s Petronas gas and oil separation project, and power plants from Aramco and Mexico’s CFE, the Shaybah project will also involve the execution of GOSP and Co-generation project elements.

Project: Shaybah NGL Programme

Country: kingdom of Saudi Arabia

Type: Natural gas Liquids (NGL)

Budget: $2.73 billion

Completion: 2014

Major players: Saudi Aramco, Samsung Engineering, Petronas, CFE

16. ASAB

Petrofac was awarded a cumulative US$2.3 billion contract by Abu Dhabi Company for Onshore Oil Operations (ADCO) in 2009 for the full development of the onshore Asab oil field.

Under the 44-month lump-sum contract, Petrofac will provide engineering, procurement and construction (EPC) services to upgrade the production capacity of the Asab field.

The rejuvenation of the Asab field is central to ADCO’s overall development plan to increase its production and achieve the committed 1.8 million barrels of oil per day contributing towards achieving Abu Dhabi’s additional crude production capacity targets.

In addition to the production capacity upgrade of Asab, Petrofac’s contract scope includes upgrading the facility’s capacity to accept increased production from Sahil, Shah and other south east fields and to upgrade the associated utilities and water handling facilities.

Project: ASAB Full Field Development

Country: UAE, Abu Dhabi

Type: Oil E&P

Budget: $2.3 billion

Completion: 2015

Major players: ADCO, Petrofac

17. South Rub Al Khali

The South Rub Al Khali Company Limited (SRAK) announced last October it had concluded its First Exploration Period and embarked on the Second Exploration Period in the Rub Al Khali in Saudi Arabia.

This comprised the drilling of seven exploration wells, acquisition of approximately 25,000 kilometers 2D seismic data, and the acquisition of 750 square kilometers of 3D seismic data.

Shell has confirmed that it has entered into the second contract period for SRAK. The company is moving forward with the appraisal of the Kidan sour gas fields too.

During the Second Exploration Period, three wells are planned to be drilled in this area, in addition to the acquisition of about 3,600 square kilometers of 3D seismic data and 3,000 kilometers of 2D seismic data.

Phase two is budgeted at $2 billion and Saipem has been contracted as EPC. Gas exploration in the South Rub Al Khali “C” area, valued at around $200 million, is in execution phase, with Eni and Repsol onboard.

SRAK is a joint venture between Saudi Aramco and Shell with equal equity holding.

Project: South Rub Al Khali E&P

Country: Kingdom of Saudi Arabia

Type: E&P

Budget: $2.2 billion

Completion: 2014

Major players: Saudi Aramco, Shell, Saipem, Eni, Repsol

18. UAE 3 Fields

Abu Dhabi National Oil Company (ADNOC) and its subsidiaries began early works on the upgrades to the Bida Qemzan, Bab and Qusahwira oilfields back in 2006.

Recent estimates have put the total project cost at around $1.8 billion. The objective of the project is to achieve a production capacity of 20,000 barrels per day by the end of the third quarter of 2012. Foster Wheeler was awarded the contract by ADCO for the PMC services for Bida Al Qemzan in 2010.

The Bab oilfield development is estimated to be worth in the region of $800 million, and is in execution phase with Technip as consultant and SK Engineering appointed as contractor.

Project: Bida Qemzan & Bab & Qusahwira upgrades

Country: UAE, Abu Dhabi

Type: Natural gas Liquids (NGL)

Budget: $1.8 billion

Completion: 2014

Major players: ADCO, Foster Wheeler, Technip, SK Engineering

19. Bahrain

Occidental and Mubadala Oil & Gas, signed a DPSA with the National Oil and Gas Authority of Bahrain for the further development of the Bahrain Field in 2009.

Oil production from the field is expected to more than double to approximately 75,000 barrels per day within five years and grow to a peak level of more than 100,000 barrels per day thereafter.

Gas production capacity is expected to grow from the current level of 1.7 billion cubic feet per day to over 2.5 billion cubic feet per day under the Field development plan.

Oxy’s net share of production is expected to grow from 28,000 boepd in 2010 to 56,000 boepd within five years.

Project: Bahrain offshore Field Development

Country: Bahrain

Type: Oil E&P

Budget: $1.8 billion

Completion: 2015

Major players: Occidental Petroleum, NOGA, PTT, mubadala O&G

20. PDO Offshore

At the close of 2010 Petroleum Development Oman (PDO) awarded a seven-year engineering and maintenance services contract (EMC) to Wood Group – CCC.

The contract, which has a three year extension option, will include integrated engineering, construction, maintenance and support services for existing PDO facilities onshore in Southern Oman.

Included in the recent 2011 briefing was the news that PDO’s challenging oil production targets, which for 2010 stood at 540,000 to 560,000 barrels per day, had been met. Daily average oil production in 2010 stood at 553,000 barrels per day, slightly above the 2009 level of 552,000 barrels per day.

Wood Group’s Production Facilities business was merged with PSN in April this year. The merger has created a service provider with annual revenues of around US$3 billion.

Project: Petroleum Development Oman offshore facilities

Country: Oman

Type: Infrastructure O&M

Budget: $800m

Completion: 2017 (2020 ext.)

Major players: Wood Group, Consolidated International Contractors Company